DroneShield Ltd. (DRO:ASX; DRSHF:OTC) has announced the release of a major firmware upgrade for Q2 2024, enhancing the capabilities of their flagship radio frequency sensors, including the RfPatrol, RfOne, and DroneSentry-X models. This update, part of the company's regular quarterly firmware upgrade cycle, is available to customers globally who are part of DroneShield's device subscription model.

The new firmware not only expands the range of drone types that can be identified but also features a complete overhaul of the underlying software. This includes a total rebuild of AI algorithms, leveraging the latest advances in machine learning to future-proof the system and boost detection performance.

In their latest research report, Bell Potter Securities has updated their recommendation on DroneShield Ltd. to "Buy" from "Hold," underlining the company’s strong market positioning and recent operational advancements. Analyst Daniel Laing emphasized the robust sales pipeline and the strategic inventory build-up which are expected to drive significant revenue growth. Bell Potter maintains a 12-month price target of $1.00 on DroneShield, reflecting a total expected return of 21%.

Daniel Laing commented, "With DroneShield’s strategic enhancements and expanded capabilities following their recent firmware upgrades, we see a clearer path to market leadership in the counter-UAS sector. The firm's focus on incorporating cutting-edge AI and machine learning technologies aligns with the growing demand for sophisticated drone defense systems." The endorsement from a major financial analyst highlights the company’s potential and reassures investors of its future trajectory in a rapidly evolving industry.

Why AI?

The integration of artificial intelligence (AI) in DroneShield's latest firmware upgrade aligns with the substantial growth observed in the anti-drone market, which is expected to reach US$5.2 billion by 2028, growing at a CAGR of 26.6%, as noted by Grandview Research. AI's pivotal role is to enhance the capabilities of DroneShield's products to identify and mitigate a broader array of drone threats effectively. This upgrade reflects a proactive response to the sector's needs, particularly in military and defense applications, where the demand for high-tech solutions is rapidly increasing due to the escalating risks associated with unauthorized drone activities.

"With DroneShield’s strategic enhancements and expanded capabilities following their recent firmware upgrades, we see a clearer path to market leadership in the counter-UAS sector. The firm's focus on incorporating cutting-edge AI and machine learning technologies aligns with the growing demand for sophisticated drone defense systems." — Daniel Laing, Bell Potter Securities

By leveraging AI, DroneShield's sensors can process vast data streams in real time, a crucial step for detecting and countering sophisticated drone technologies that might otherwise evade traditional detection methods.

The firm's AI-driven approach, revamped to incorporate the latest in machine learning, enables adaptive threat detection and response capabilities, an important step as suggested by Markets and Markets, among others. This strategic update positions DroneShield at the forefront of the counter-drone industry, ensuring their technology not only meets current security demands but is also poised to adapt to future challenges, as highlighted by the significant ongoing investments in AI across the defense sector.

Catalysts

The impetus for DroneShield's firmware upgrade is multifaceted, driven by technological advancements, market demands, and regulatory changes. This market expansion is underpinned by a rising incidence of security breaches involving unauthorized drones, which pose a significant threat to critical infrastructures, military assets, and public safety. As Airsite noted, this issue was addressed by the FAA, and global airspace security continues to call for innovative solutions, which DroneShield aims to meet with its AI-enhanced firmware.

Moreover, technological catalysts also play a crucial role. The development of new AI capabilities within DroneShield's products is a direct response to the evolving sophistication of drone technology itself. As drones become more capable, the systems designed to detect and neutralize them must advance correspondingly. This technology-driven arms race necessitates continuous updates and improvements, ensuring that security measures are always several steps ahead of potential threats.

Angus Bean, CTO of DroneShield, highlighted the significance of these updates in maintaining the company's competitive edge. Security technology analysts also emphasize the importance of integrating cutting-edge AI into defense mechanisms against drones, which not only improves effectiveness but also ensures adaptability to future threats. The enhanced features, like advanced hardware control and clearer actionable warnings, are seen as direct responses to the evolving needs of defense and security sectors, reflecting a deep understanding of market demands and regulatory frameworks.

Expert Analysis

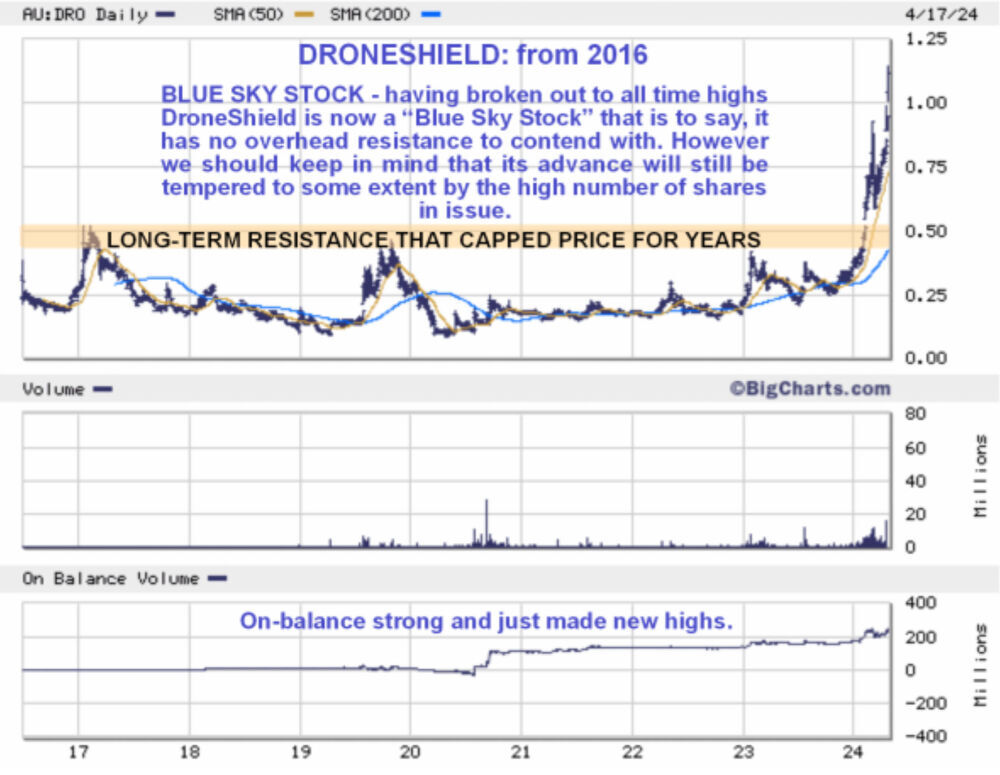

Industry experts have praised DroneShield's strategic update, noting its potential to set new standards in the counter-drone sector. As noted by Technical Analyst Clive Maund in an article on April 24, "The long-term chart (at left) going back to 2016 shows that it is just this year that DroneShield has finally broken out of the long trading range that it had been stuck in for years, thanks to the latest developments, we can now classify it as a giant base pattern."

Industry experts have praised DroneShield's strategic update, noting its potential to set new standards in the counter-drone sector. As noted by Technical Analyst Clive Maund in an article on April 24, "The long-term chart (at left) going back to 2016 shows that it is just this year that DroneShield has finally broken out of the long trading range that it had been stuck in for years, thanks to the latest developments, we can now classify it as a giant base pattern."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

DroneShield Ltd. (DRO:ASX; DRSHF:OTC)

On April 15, Bell Potter analyst Daniel Laing wrote in a research note, "DroneShield released a robust 1Q24 update, which demonstrated the significant growth in the business over the last 12 months." He went on to add that the company "has maintained its strong performance in 2024, and we remain positive on the long-term outlook for the company."

Ownership and Share Structure

Management and insiders own 11% of the company. CEO Oleg Vornik owns 2.23% of the company with 15 million options, on a fully diluted basis. Non-Executive Chairman Peter James owns 0.58% of the company with 920k shares and 3 million options, on a fully diluted basis, and Non-Executive Director Jethro Marks owns 0.22%, with 1.5 million options, on a fully diluted basis, according to DroneShield.

The company reports that the largest independent investor, Charles Goode, owns 4.41% of the company with 21.5 million shares, while strategic investors own a total of 13.99% of the company.

Eprius Inc. is the second largest shareholder, with 3.16% of the company having 18.5 million shares.

The company reports that there are about 704 million shares outstanding and about 526.8 million free-float traded shares. Its market cap is about AU$582.6 million, and it trades in a 52-week range of AU$0.99 and AU$1.145.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of DroneShield Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.